rfid chips in cdebit cards RFID credit cards are considered to be as safe as EMV chip cards, and data theft concerning RFID cards is uncommon. This is because of how these cards transmit information and what. $6.99

0 · rfid embedded credit cards

1 · rfid credit card check

2 · rfid credit card

3 · rfid chip scanning

4 · rfid chip

5 · rfid card logo

6 · how to protect rfid chip

7 · credit card rfid tags

4FF is the size, BULK and DFILL are the channel they're sent from/through to. (I think usually .Verizon Wireless 4G LTE Certified NFC 4FF SIM Card is compatible with several Verizon Wireless 4G LTE devices. This product is "nano" sized, and is only .Some 4G LTE devices use a NFC nano SIM card, which is the same size as a regular Nano SIM Card with an additional level of security that protects your .

rfid embedded credit cards

rfid based attendance system using arduino and gsm

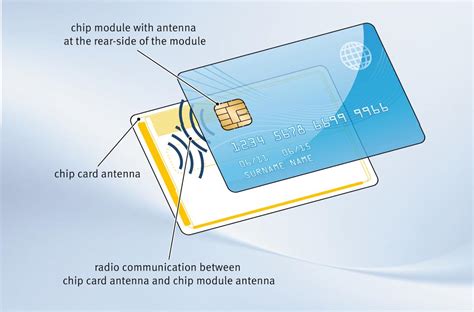

RFID credit cards are considered to be as safe as EMV chip cards, and data theft concerning RFID cards is uncommon. This is because of how these cards transmit information and what. RFID credit cards are considered to be as safe as EMV chip cards, and data theft concerning RFID cards is uncommon. This is because of how these cards transmit information and what. To keep your RFID credit cards safe, keep your card in an RFID shield wallet or sleeve to block RFID scanners from reading your personal information. If you don’t have one of these sleeves, try putting several RFID cards together in your wallet to make it harder for the scanner to isolate an individual card. RFID payments work by transmitting information between a credit card — specifically, the computer chip and antenna embedded within it — and a contactless reader. That information takes the .

You probably know that the embedded computer chips found in most credit and debit cards are meant to protect you from financial fraud. But you may have also heard of a scam called RFID skimming, where a thief steals the card number from your chip-embedded card just by walking past you.

RFID-enabled credit cards - also called contactless credit cards or “tap to pay” cards - have tiny RFID chips inside of the card that allow the transmission of information. The RFID chip itself is not powered, but instead relies on the energy transferred by an RF-capable payment terminal.What does the RFID symbol on my card mean? The RFID-looking symbol on a debit or credit card is the EMVCo Contactless Indicator * . It indicates that your card can be used to tap to pay on a contactless-enabled payment terminal. An RFID chip credit card, also known as a contactless credit card or a tap-and-go card, is a type of payment card that contains an embedded RFID chip. This chip uses radio frequency identification technology to securely transmit payment information wirelessly to a payment terminal. Passports and some credit cards have RFID chips that allow information to be read wirelessly. An industry has sprung up to make wallets and other products that block hackers from "skimming".

Contactless payment allows consumers to pay for goods and services using their debit or credit cards with RFID technology—also known as chip cards —or other payment devices without the need to.

Contactless cards use radio-frequency identification (RFID) and near-field communication (NFC) technologies. They enable the card to communicate with the card reader when the card is held near the reader during a transaction. RFID credit cards are considered to be as safe as EMV chip cards, and data theft concerning RFID cards is uncommon. This is because of how these cards transmit information and what. To keep your RFID credit cards safe, keep your card in an RFID shield wallet or sleeve to block RFID scanners from reading your personal information. If you don’t have one of these sleeves, try putting several RFID cards together in your wallet to make it harder for the scanner to isolate an individual card.

rfid credit card check

RFID payments work by transmitting information between a credit card — specifically, the computer chip and antenna embedded within it — and a contactless reader. That information takes the . You probably know that the embedded computer chips found in most credit and debit cards are meant to protect you from financial fraud. But you may have also heard of a scam called RFID skimming, where a thief steals the card number from your chip-embedded card just by walking past you. RFID-enabled credit cards - also called contactless credit cards or “tap to pay” cards - have tiny RFID chips inside of the card that allow the transmission of information. The RFID chip itself is not powered, but instead relies on the energy transferred by an RF-capable payment terminal.What does the RFID symbol on my card mean? The RFID-looking symbol on a debit or credit card is the EMVCo Contactless Indicator * . It indicates that your card can be used to tap to pay on a contactless-enabled payment terminal.

An RFID chip credit card, also known as a contactless credit card or a tap-and-go card, is a type of payment card that contains an embedded RFID chip. This chip uses radio frequency identification technology to securely transmit payment information wirelessly to a payment terminal.

Passports and some credit cards have RFID chips that allow information to be read wirelessly. An industry has sprung up to make wallets and other products that block hackers from "skimming". Contactless payment allows consumers to pay for goods and services using their debit or credit cards with RFID technology—also known as chip cards —or other payment devices without the need to.

$41.99

rfid chips in cdebit cards|rfid card logo