credit card companies getting smarter about fee A 2022 study released by The Straw Group (an analytics company specializing in the payments industry) found 23% of small businesses charge customers paying with a credit card an extra fee. A full breakdown of the 2022 NFL playoff seeding and the schedule for the NFL's Super Wild Card Weekend. . Below is a full breakdown of the 2022 NFL playoff seeding and the schedule for the NFL's Super Wild Card .

0 · mastercard credit card fees

1 · how to increase credit card fees

2 · credit card transfer fee increase

$9.99

Merchants paid 6 billion in credit card fees in 2022, up 20% from 2021, The pushback is playing out in lobbying campaigns and Congress.

A 2022 study released by The Straw Group (an analytics company specializing in the payments industry) found 23% of small businesses charge . Merchants paid 6 billion in credit card fees in 2022, up 20% from 2021, The pushback is playing out in lobbying campaigns and Congress. A 2022 study released by The Straw Group (an analytics company specializing in the payments industry) found 23% of small businesses charge customers paying with a credit card an extra fee. The following are questions credit card issuers should be asking themselves or looking into to get ahead of future revisions to Regulation Z: Can you demonstrate how you determined late-fee amounts are proportionate to collection costs? Are you following the Fed’s safe harbor limit provisions?

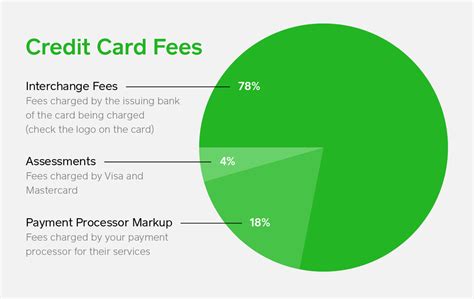

Retailers have been complaining that credit card companies have the upper hand - charging them "swipe fees" when customers use cards. A bipartisan bill is in the works that could change. Credit card processing fees can add up to a big expense for merchants. Here are the average fees and costs for many issuers and payment networks in 2024.

Although these cards may offer perks like travel points, cashback or exclusive benefits, the annual fee can range from to well over 0, depending on the card. How to avoid this fee: Some . Reducing your credit card processing fees doesn’t have to be a complicated process. By understanding what drives your costs, leveraging tools like Level 2 and 3 data, maximizing discounts, and exploring options to pass fees on to customers, you can take control of your fees and start saving.

9 credit card fees you don’t have to pay. If you want to use credit to your advantage, try to avoid unnecessary credit card fees and charges. Below, you’ll find nine common credit.

It’s true: credit card fees cost them money on each transaction. But not taking credit cards could cost them more business in the long run. So what’s the right thing to do for you as a. Below is a deep dive into credit card surcharges for businesses: how they work, what benefits they can provide, and best practices for implementing credit card surcharges in a strategic way that doesn’t undermine customer satisfaction. Merchants paid 6 billion in credit card fees in 2022, up 20% from 2021, The pushback is playing out in lobbying campaigns and Congress.

A 2022 study released by The Straw Group (an analytics company specializing in the payments industry) found 23% of small businesses charge customers paying with a credit card an extra fee. The following are questions credit card issuers should be asking themselves or looking into to get ahead of future revisions to Regulation Z: Can you demonstrate how you determined late-fee amounts are proportionate to collection costs? Are you following the Fed’s safe harbor limit provisions? Retailers have been complaining that credit card companies have the upper hand - charging them "swipe fees" when customers use cards. A bipartisan bill is in the works that could change. Credit card processing fees can add up to a big expense for merchants. Here are the average fees and costs for many issuers and payment networks in 2024.

Although these cards may offer perks like travel points, cashback or exclusive benefits, the annual fee can range from to well over 0, depending on the card. How to avoid this fee: Some . Reducing your credit card processing fees doesn’t have to be a complicated process. By understanding what drives your costs, leveraging tools like Level 2 and 3 data, maximizing discounts, and exploring options to pass fees on to customers, you can take control of your fees and start saving. 9 credit card fees you don’t have to pay. If you want to use credit to your advantage, try to avoid unnecessary credit card fees and charges. Below, you’ll find nine common credit. It’s true: credit card fees cost them money on each transaction. But not taking credit cards could cost them more business in the long run. So what’s the right thing to do for you as a.

mastercard credit card fees

64kb smart card

NTAG215 NFC Inkjet Print Cards both sides can be printed compatible with Epson & Canon Inkjet Printers, NOT FOR USE IN PVC CARD .

credit card companies getting smarter about fee|credit card transfer fee increase